An organization or institution that engages a volunteer may reimburse the volunteer for certain expenses related to volunteering. These expenses include food, accommodation, travel, medical expenses, and telephone services. Such reimbursements are not taxable if they do not exceed the amounts established by law and are properly documented. In addition, the possibility of such reimbursements should be stipulated in the contract on carrying out volunteer activities.

As part of cooperation with the National Social Service of Ukraine, CEDEM has developed and offers templates of the volunteering agreement for public authorities (local self-government) and civil society organizations to be concluded with a volunteer! You can download the templates and learn more about the agreement here.

Volunteering agreementWhat expenses can the non-profit organization reimburse the volunteer and how? |

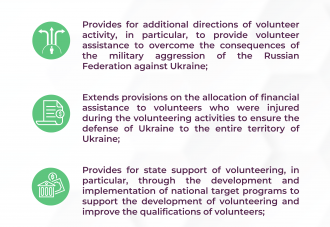

What expenses can the non-profit organization reimburse the volunteer and how?Is reimbursement of volunteer expenses by a non-profit organization taxable?The Law of Ukraine 25No. 20-IX of August 15, 2022 (entered into force on 09/03/2022) amended the Tax Code of Ukraine. Funds or the cost of property (services) provided to a volunteer, in terms of expenses of a non-profit organization that engages volunteers in its activities, for medical examination and vaccination of a volunteer and other healthcare measures directly related to the provision of volunteer assistance by such a person (para. 165.1.64 of the TCU) Reimbursement by a non-profit organization to a volunteer of documented expenses associated with the provision of volunteer assistance, in accordance with Article 11 of the Law of Ukraine “On Volunteering” (para. 165.1.65 of the TCU)

|

What expenses can the non-profit organization reimburse the volunteer and how?What types of expenses can be reimbursed in accordance with article 11 of the Law of Ukraine “On Volunteering”?Business trips within the territory of Ukraine and abroad within the limits of reimbursement of travel expenses, established for civil servants Medical examination, vaccination and other healthcare measures directly related to the provision of volunteer assistance Accommodation if the volunteer is traveling to another locality (duration of volunteering is more than 8 hours) Travel (including luggage transportation) to the place of volunteering Postal and telephone services related to the volunteer activity Meals (duration of volunteering more than 4 hours per day) Obtaining a visa |

What expenses can the non-profit organization reimburse the volunteer and how?What documents should a volunteer keep to get reimbursement?Transport tickets, baggage receipts (if any) Bills received from hotels (motels) Other settlement or payment documents if this category of expenses is eligible for reimbursement under Article 11 of the Law of Ukraine “On Volunteering”. |

What expenses can the non-profit organization reimburse the volunteer and how?Regulatory documents on the basis of which the amount (limits) of reimbursements is established: Maximum amount of per diem for meal expenses per volunteer: 300 UAH/day Maximum accommodation expenses (residential premises rental): 900 UAH/day The procedure for drawing up the report on the use of funds issued for a business trip or funds to be accounted for, approved by the order of the Ministry of Finance of Ukraine dated September 28, 2015 No. 841. |

These materials were prepared jointly with the National Social Service of Ukraine as part of the Project “Ukraine Civil Society Sectoral Support Activity”, with the support of USAID Ukraine.