Many volunteers who raise funds to help the military and war-affected civilians are still facing the question: Whether to get registered in the register of volunteers of the State Tax Service (Register of Volunteers of anti-terrorist operation and/or implementation of measures to ensure national security and defense, repulsion and deterrence of armed aggression of the Russian Federation)? And if they did register – how and where should they report on the raised funds?

In this article, we explain the situation with the submission of the Declaration of Assets and Income.

Law No. 3050-IX of 04/11/2023 amended the Tax Code of Ukraine (para. 179.2 of Article 179) according to which: “The obligation of a taxpayer to submit a tax declaration shall be deemed fulfilled and a tax declaration shall not be submitted if such taxpayer received income, including foreign income, which according to this Code is not included in the total monthly (annual) taxable income.”

Therefore, if you are a volunteer (according to the law, a benefactor – a natural person), raised funds on your bank card account to help the AFU and you are included in the Register of Volunteers, then in accordance with the provisions of subparagraph “b” of subparagraph 165.1.54 of paragraph 165.1 of Article 165.1 of the TCU, your income is not included in the calculation of the total monthly (annual) taxable income. Accordingly, such an individual benefactor does not need to submit a Declaration of Assets and Income.

That is, volunteers can refer to the provisions of para. 179.2 of Art. 179 of the Tax Code of Ukraine and should not submit the Declaration of Assets and Income in 2023.

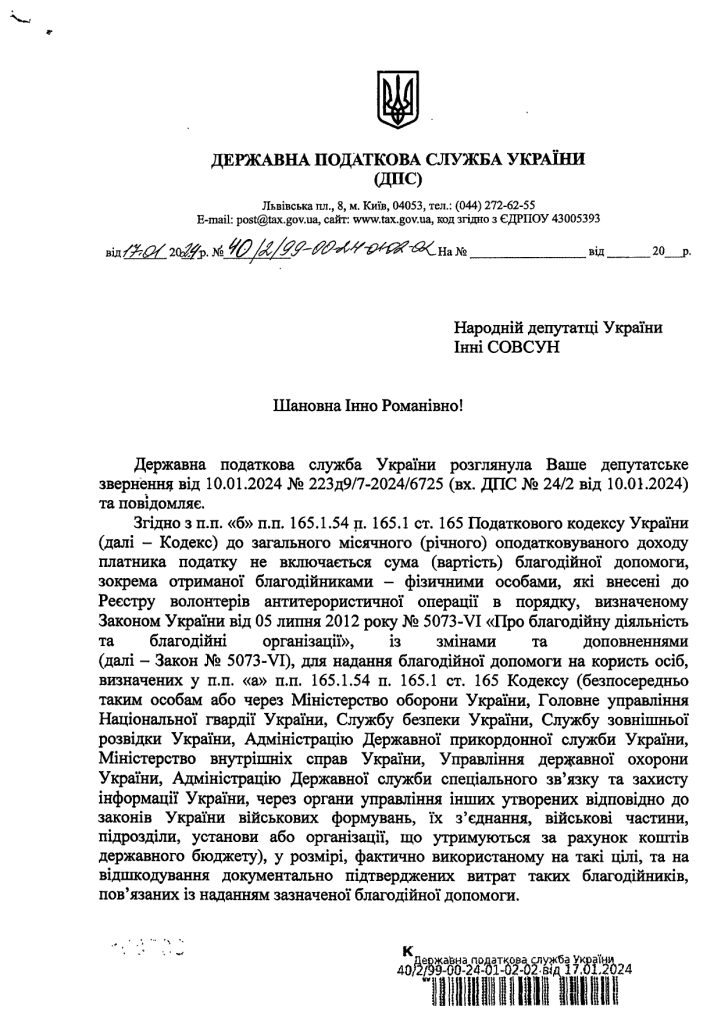

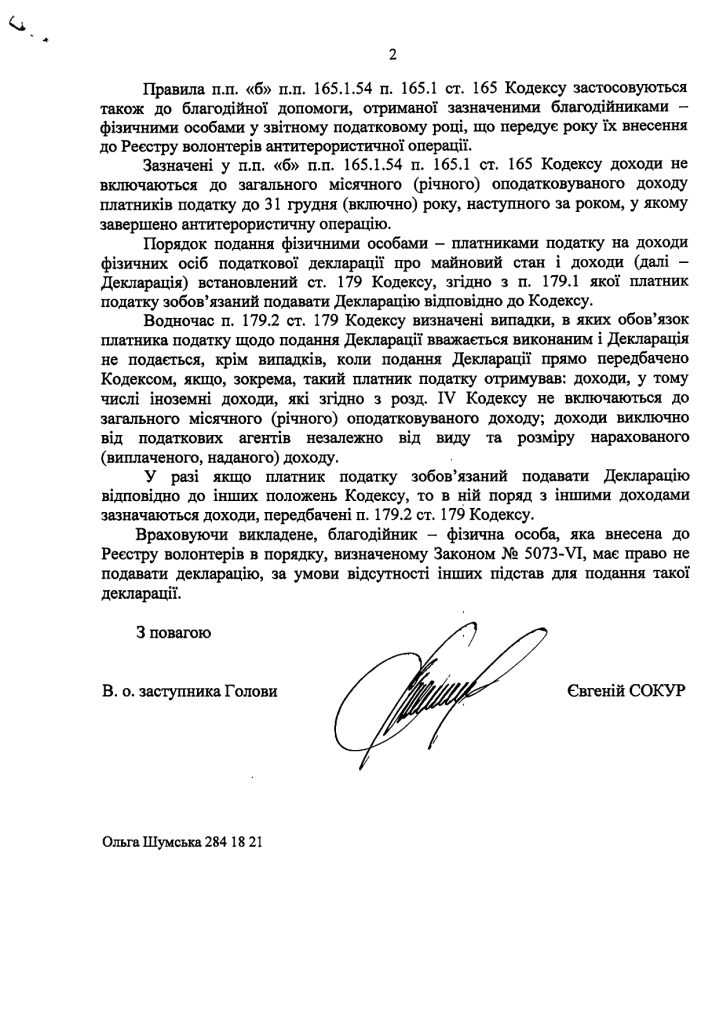

In confirmation of the relevant conclusion, we have the response of the State Tax Service of Ukraine to the appeal of MP Inna Sovsun.

According to the State Tax Service (STS), an individual benefactor entered in the Register of Volunteers, which is maintained by the STS in accordance with the Law of Ukraine “On Charitable Activities and Charitable Organizations” has the right not to submit a Declaration of Assets and Income, in the absence of other grounds for the submission of such a declaration.

Therefore, for example, if an individual benefactor is also an individual entrepreneur under the general system of taxation (and therefore must file a Declaration of Assets and Income), they will have to indicate the amount of raised charitable funds when filing a declaration.

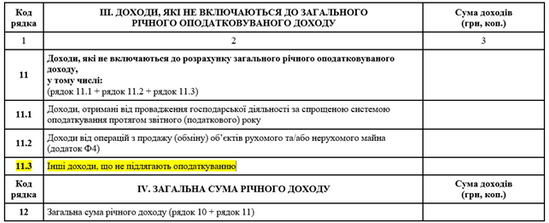

And if desired, an individual benefactor can file a declaration and report on the funds raised for charity. However, it should be noted that there is no separate box in the declaration form for reporting on funds raised for the needs of the military or civilian victims. Amounts of received charitable funds should be reported in line 11.3 of Section III “Income not included in the total annual taxable income” of the Declaration of Assets and Income.

Also note that the Law No. 3050-IX came into force only on 05/06/2023, so its effect does not apply to previous reporting years.

In addition, the possibility of not filing a declaration does not exempt a volunteer who has registered in the Register of the State Tax Service from the obligation to have and keep documentary evidence of expenses related to the provision of charitable assistance (cheques, statements, acceptance certificates, etc.). After all, this is required by the provisions of subparagraph b) of subparagraph 165.1.54 of paragraph 165.1 of the Tax Code of Ukraine.

According to subparagraph 49.18.4 of paragraph 49.18 of Article 49.18 of the Tax Code of Ukraine, the Declaration shall be submitted according to the results of the year – until May 1 of the year following the reporting year. That is, the Declaration based on the results of 2023 should be filed by May 1, 2024.

This material was prepared by CEDEM as part of the Project Ukraine Civil Society Sectoral Support Activity implemented by the Initiative Center to Support Social Action “Ednannia” in partnership with the Ukrainian Center for Independent Political Research (UCIPR) and Centre for Democracy and Rule of Law (CEDEM).