CEDEM held a series of trainings to improve banking services for civil society organizations and mitigate legislative challenges in the field of combating money laundering and terrorist financing

On April 24, 2023, the first online training in a series of trainings for civil society organizations “Peculiarities of Financial Monitoring in the Banking Services for NGOs and Charitable Organizations” was held, organized by CEDEM with the direct participation and support of the Independent Association of Banks of Ukraine.

The speakers were representatives of the two largest Ukrainian banks, Oschadbank and PrivatBank.

Ihor Tkalych, Director of the General Department of Financial Monitoring of Oschadbank, spoke about the peculiarities of due diligence of non-profit institutions held by banks. In particular, he pointed out that the grounds and guide for such a due diligence is the Regulation on Financial Monitoring by Banks approved by the National Bank of Ukraine (Resolution dated May 19, 2020 No. 65). At the same time, when establishing business relations, in particular when opening accounts, banks apply the general KYC approach (“know your customer”), that is, they must identify and establish their client before conducting a financial transaction.

For this purpose, banks ask for general information about the purpose, founders and governing bodies of an NGO, whether there are politically exposed persons among them, and the main sources of funds. Banks can also receive information from open sources. Such information allows the bank to determine the risk level of each client.

PrivatBank was represented by Halyna Kotsiubiichuk, Chief Customer Research Expert, Yevheniia Kozachuk, Head of the Department of In-Depth Analysis of Customer Operations, and Yurii Yehorov, Deputy Head of the Department of Anti-Money Laundering, Compliance and Financial Monitoring of PrivatBank.

Halyna Kotsiubiichuk stressed the banks’ obligation to consider the clarifications and recommendations of the NBU, as a state financial monitoring entity, which, in accordance with the law, performs the functions of state regulation and supervision of the subject of primary financial monitoring. In pursuance of the NBU requirements, the bank developed a Description of Non-Profit Organization’s Activities, which contains the key questions necessary for the bank to conduct due diligence of the client, for example, regarding the purpose (mission) of the organization, methods of finding donors, purposes of using funds, mechanism of funds distribution, implemented projects/programs, whether cash inflows and expenses are planned in the activities of the organization.

It is important to correctly fill in this description, which will contain complete answers, allowing the bank to use this document as a source of objective information.

Yevheniia Kozachuk focused on the requirements for confirming the sources of the funds of charitable organizations, in particular, on the compliance of the supporting documents with the requirements of the law and the real content of the transactions, their economic component. She emphasized that in case of doubt, the bank will definitely ask for additional information to ensure a clear understanding of the content of the transaction.

Yurii Yehorov noted the peculiarities of the bank’s communication with the client, pointed out that planned communication begins 60 days before the expiration of the client’s questionnaire. In some cases, the bank can extend the communication period by 15 days. If the bank fails to obtain the information required for the updating, it suspends the debit transactions on the client’s account and denies the use of the bank’s new products.

This event was organized and held with the direct assistance and participation of the Independent Association of Banks of Ukraine. The head of the Financial Monitoring working group of the NABU Committee on Regulatory Policy and Compliance, Polina Kharchenko, thanked the organizers and participants of the training for the informative meeting and expressed readiness for further dialogue with the representatives of non-profit public organizations to create the most effective conditions for joint work.

The recording of the training can be found at the link.

On April 26, 2023 the second online training for the representatives of the financial monitoring departments of the banking institutions and experts in the field of financial legislation “Peculiarities of activities of NGOs and charitable organizations and their risk mitigation factors” was held.

The event was organized by CEDEM with the direct participation and assistance of the Office of the Council of Europe Office in Ukraine. Speakers were experts from the Council of Europe and CEDEM.

Representatives of Ukrainian banks, the National Bank of Ukraine, the Ministry of Finance of Ukraine and other experts in the field of financial monitoring joined the event.

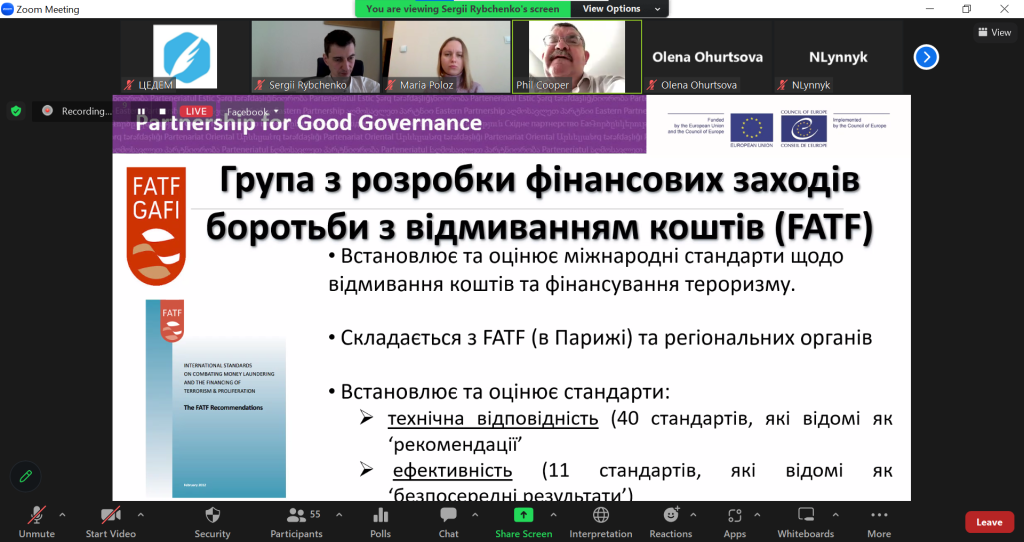

Serhii Rybchenko, the coordinator of the EU/Council of Europe project “Improving the Anti-Money Laundering, Terrorist Financing and Asset Recovery Regime” in Ukraine, emphasized the impact of the role of civil society organizations, which has become more evident over the past year, and the need for state authorities and primary financial monitoring entities to take this into account, the importance of applying a risk-based approach, ensuring CSOs have access to the financial services they need.

Філі Купер, міжнародний експерт Ради Європи, зосередив свій виступ на міжнародних стандартах, розумінні оцінки та зменшенні ризиків, пов’язаних з неприбутковими організаціями (НПО).

Пан Купер зауважив, що стандарти ФАТФ вимагають доступного та простого регулювання, визнання легітимності сектору НПО, регулювання на основі ризику, співпраці та роз’яснювальної роботи, обміну інформацією, міжнародного визнання загроз і режиму санкціонування.

За його словами, усі НПО повинні мати доступ до систем, які дозволяють їм працювати в регульованих каналах. А саме доступ до банківської системи має важливе значення та зменшує ризик використання НПО альтернативних систем.

Також пан Купер запропонував банкам враховувати декілька важливих аспектів, які дозволять покращити порозуміння із ОГС, а саме співпрацювати з партнерськими організаціями, отримуючи консультації та підтримку, ділитись інформацією про причини занепокоєння, однак не відмовляти необґрунтовано від надання банківських послуг, вживати заходів належної перевірки, що дозволяє уникнути ризику та відкриває сектор для підтримки та регульованої банківської діяльності.

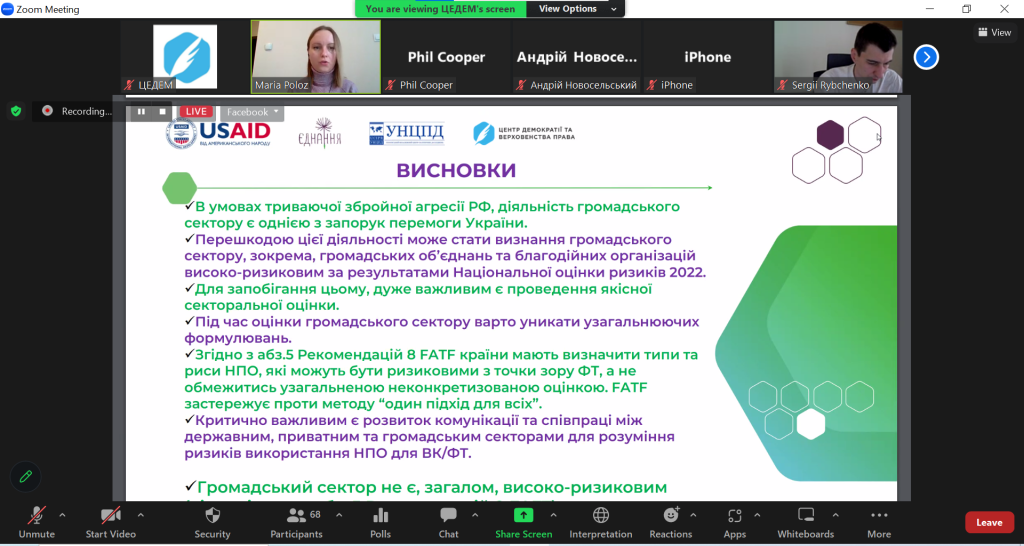

Mariia Poloz, a CEDEM lawyer, highlighted the factors that may indicate a decrease in the level of NPO risk, and examples of their identification and application.

She noted that the activity of CSOs in the times of war is one of the keys to the victory of Ukraine, while the recognition of CSOs as high-risk, as indicated in the Independent Risk Assessment 2022, is an obstacle to effective work. Ms. Mariia emphasized that the FATF recommendations, which do not automatically recognize NPOs as high-risk, should be taken into account and applied, and therefore it is currently relevant to carry out a qualitative and substantiated sectoral assessment of NPOs.

The recording of the training can be found at the link.

The series of trainings was organized as part of the Project Ukraine Civil Society Sectoral Support Activity implemented by the Initiative Center to Support Social Action “Ednannia” in partnership with the Ukrainian Center for Independent Political Research (UCIPR) and Centre for Democracy and Rule of Law (CEDEM) with the sincere support of the American people through United States Agency for International Development.